GA, UNITED STATES, January 16, 2026 /EINPresswire.com/ — Researchers introduce a new asset pricing factor called “emotional vulnerability” by combining large language models and network analysis of investor sentiment. By embedding stock forum texts and measuring network curvature, they show that emotionally vulnerable stocks tend to deliver lower returns, while emotionally stable stocks generate higher excess returns. The factor remains effective after controlling for traditional risk factors and sentiment direction.

Financial markets are increasingly shaped by investor emotions, yet most sentiment indicators focus only on whether investors feel optimistic or pessimistic. A new study published in Risk Sciences introduces a different perspective: instead of sentiment direction, it measures how fragile or unstable investor emotions are.

Researchers from the Central University of Finance and Economics in Beijing propose a novel concept called emotional vulnerability, which captures fluctuations and instability in market sentiment. The study combines large language models (LLMs) with network structure analysis to quantify this previously unexplored dimension of investor behavior.

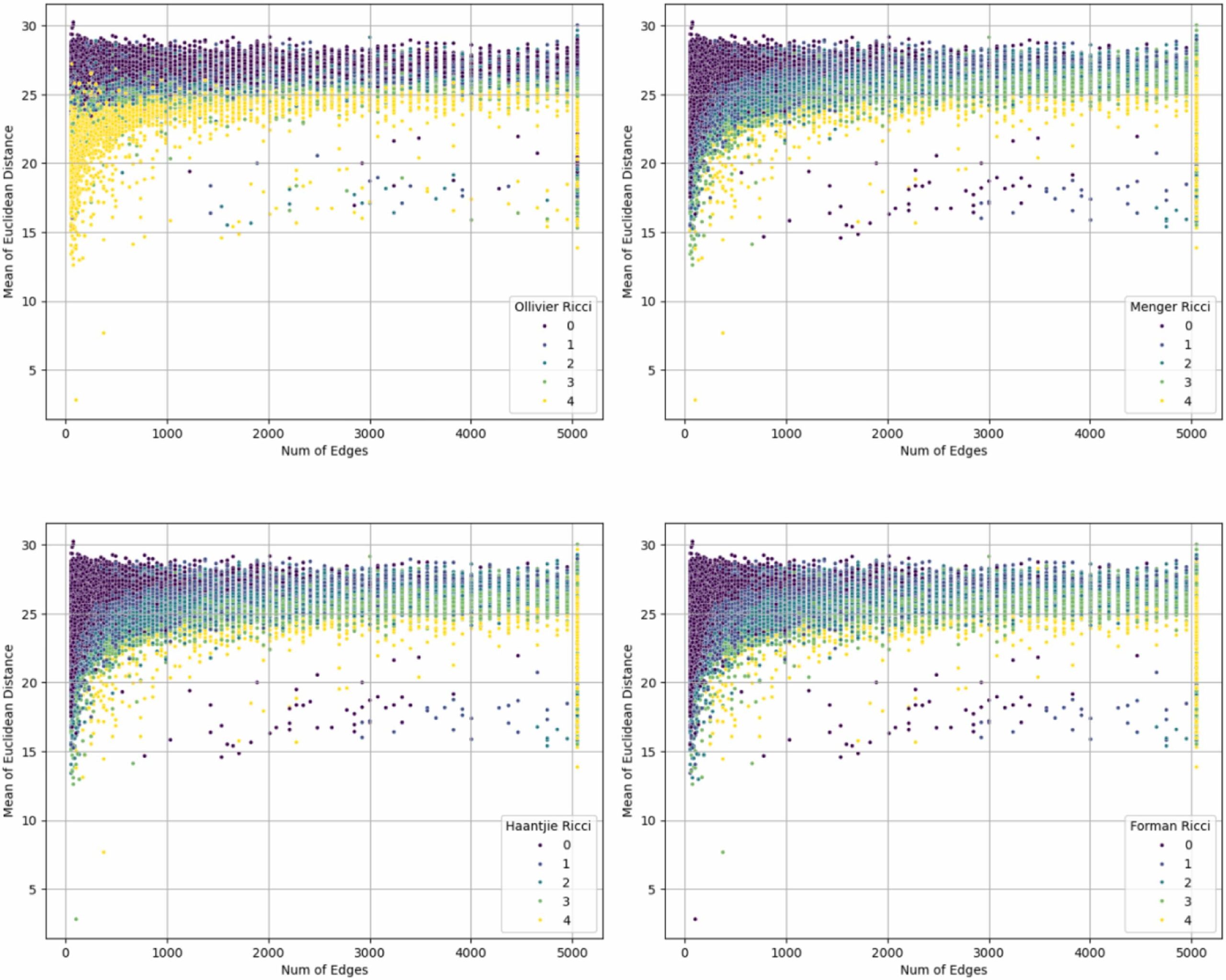

The team analyzed millions of stock forum posts from China’s A-share market. Using the Moka Massive Mixed Embedding (M3E) model, an advanced large language model for Chinese text, they converted investor comments into numerical vectors. These vectors were then used to build sentiment networks for individual stocks, where connections reflect similarities in investor opinions.

“The vulnerability of each sentiment network was measured using Ricci curvature, a concept from geometry that has been widely applied in financial system risk analysis,” shares corresponding author Ning Zhang, a professor at the university. “In this context, higher curvature indicates tighter connections and more homogeneous investor sentiment, making markets more fragile when disrupted.”

The results showed that when emotional vulnerability is high, stock prices tend to fall or become unstable, whereas when emotional vulnerability is low, markets exhibit stronger resilience and generate higher excess returns.

“We also found that portfolios consisting of emotionally stable stocks consistently outperform those with high emotional vulnerability. This relationship remains significant even after controlling for traditional asset pricing factors, including the Fama–French five-factor model, as well as for sentiment direction (optimistic or pessimistic),” adds Zhang.

By shifting attention from sentiment direction to sentiment structure, the research expands the toolkit of empirical asset pricing. The authors suggest that emotional vulnerability can improve risk assessment, enhance market trend prediction, and support more informed investment decision-making.

References

DOI

10.1016/j.risk.2025.100049

Original Source URL

https://doi.org/10.1016/j.risk.2025.100049

Lucy Wang

BioDesign Research

email us here

Legal Disclaimer:

EIN Presswire provides this news content “as is” without warranty of any kind. We do not accept any responsibility or liability

for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this

article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()